The government of Lao PDR is focused on creating a strong foundation for economic growth. Short, medium and long-term planning are key elements of this, with the 9th National Socio-Economic Development Plan (NSEDP) 2021-2025 guiding policy priorities across government in line with the country’s economic and development transformation targets. The plan is set to guide policymaking to advance sustainable and inclusive growth, human capital investment, infrastructure development and progress towards the smooth transition from Least Developed Country status.

The government has made it a priority to improve the business environment by enhancing Ease of Doing Business (EODB) through a Prime Minister’s decree that set targets for improving on indicators.

In trade, Lao PDR continues to deepen economic integration by strengthening established ties with core export markets in the region as well as expanding in key growth markets and frontier destinations. EIU expects exports of goods and services to rise by 13.3% in 2021. warming demand in neighbouring countries such as China, Thailand and Vietnam will yield a genuine lift to Laos’s exports. We forecast imports of goods and services to expand by a slower rate than exports, at 8.2% in 2021, meaning that the external sector will make a positive net contribution to GDP that year.

It is forecasted that Laos’s economy will grow by 4.8% in 2021. This forecast assumes that Laos will continue to avoid a large-scale coronavirus outbreak domestically. Real GDP expansion will pick up to 6.3% in 2022.

Meanwhile, diversification is supported by investment flows into various sectors and contributions to GDP are becoming increasingly service-driven. Sectors of business being offered investment incentives include those using high and modern technology, scientific research and development; and using innovation and efficient use of natural resources and energy. Incentives include tax and custom duty incentives and value added tax incentives; exemption of rentals and concessions of royalty of state land.

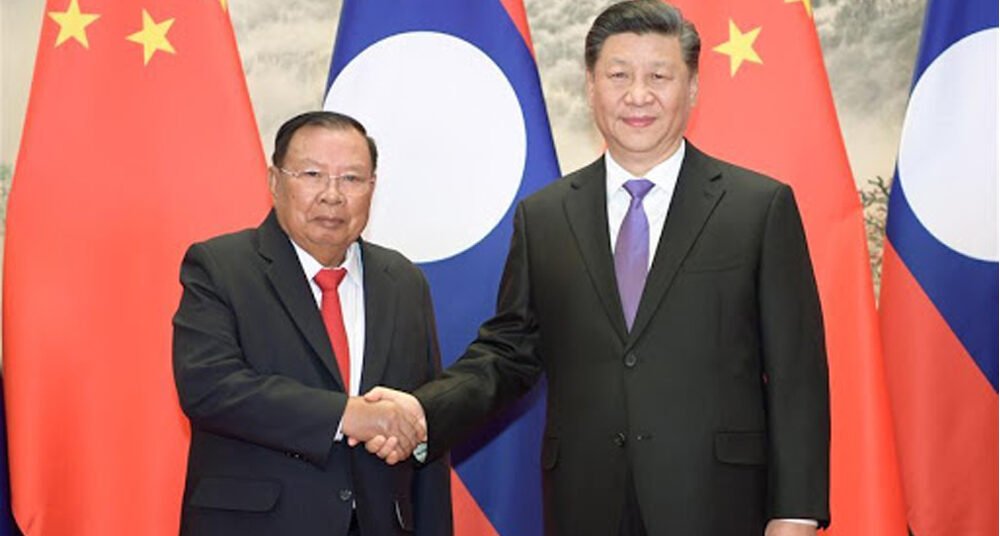

The foreign direct investment (FDI) will continue to be strong especially from China. The majority of investment will continue to be allocated to transportation infrastructure, hydropower dams, power transmission lines and resource extraction.

The government is leveraging the country’s 12 special economic zones (SEZs). Some including the Savan Seno SEZ have shown great success in promoting ease of doing business, including services for start-ups, aftercare, logistics and linkage with key neighbouring markets, promoting value chain advancement and backward linkages to the local economy.

Ishaan Malik is our Head – Client Relations (ASEAN and Australia). Through his prior experience at TCG-Digital, Ernst & Young, and Clearwater Capital Partners Ishaan has gained experience in Sales, Marketing and Risk across a diverse set of industries, thus affording him an eclectic knowledge base to support our clients’ aspirations in ASEAN.

Stay up to update with our latest news.

Have Us Contact You