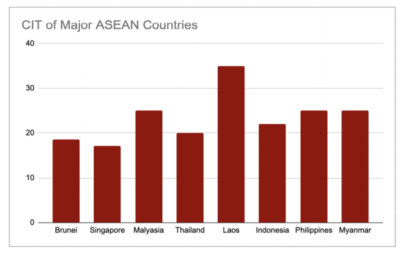

Corporate Income Tax (CIT)-Brunei after Singapore is the most tax amicable country in the ASEAN region. The chart below depicts the comparative tax rates for the different countries in the ASEAN region. The Corporate Income Tax rate in Brunei is 18.5%. At 18.5%, the rate is well below the average for these 8 countries which lies at 22%. It is the second lowest after Singapore.